Dive Brief:

- Over the next three years, 42% of firms expect to spend more than 30% of their cloud budget on generative AI, according to a survey of 215 North American IT buyers published by TD Cowen earlier this month. Nine in 10 leaders expect generative AI use cases to account for 10% of the cloud budget.

- Enterprise generative AI workloads are moving rapidly to public cloud hyperscalers such as Oracle, Microsoft, Google and Amazon. Generative AI usage has increased across nearly all functions within organizations, according to TD Cowen. The survey findings revealed that IT buyers’ cloud spend on generative AI workloads will rise fourfold by 2028.

- “As more than 90% of large enterprises deploy Gen AI applications by 2028, IT leaders must prepare for higher costs tied to advanced infrastructure and new workloads,” Hardeep Singh, a principal analyst at Gartner, told CIO Dive.

Dive Insight:

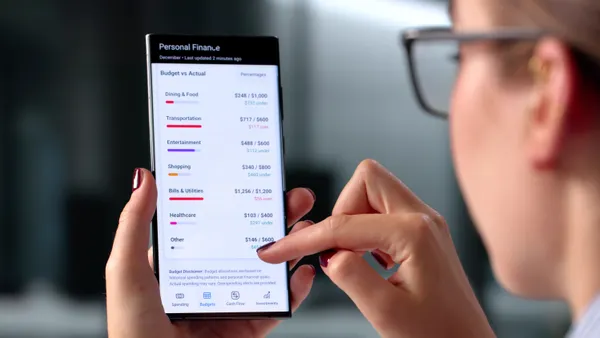

As generative AI workloads increase cloud budgets, it could affect the way IT leaders manage their cloud platform costs.

CIOs are often taking a multi-pronged approach to managing spend, including negotiating commitment-based contracts with vendors to increase cost transparency and capacity guarantees, Singh said. Deployment of cost management tools also helps IT leaders track usage and optimize available resources. CIOs are increasingly turning to cost tracking practices such as FinOps to analyze cloud spend.

A key strategy includes “right-sizing cloud environments” by matching resource allocation with workload requirements and implementing autoscale strategies to adjust capacity based on demand, Singh said.

“These measures help organizations ensure efficient consumption and keep cloud spending aligned with financial goals as AI adoption accelerates,” he said.

As IT executives seek more value from their cloud products, Singh said enterprises want to go beyond basic cloud services to products tailored to their business needs. Hyperscalers are responding by investing billions into their cloud and AI buildouts.

Data sovereignty regulatory requirements are also driving demand for specialized or hybrid cloud products to ensure compliance, he added. SAP, for example, is pouring billions into building out its sovereign cloud offerings in Europe.

“Enterprises are moving beyond generic cloud services toward more industry-specific solutions that address unique regulatory and operational needs,” Singh said.