Dive Brief:

-

Two-thirds of wealthy investors in North America prefer hybrid financial advisory services over human-only or robo-only advisory services. This is especially true when it comes to "ease of money management, digital tools, explanation of fees, customized services and low-cost products," according to a new report from Accenture.

-

"Significant numbers of millennials and Gen Xers have already turned to hybrid services," said Kendra Thompson, managing director and head of Accenture’s global wealth management practice.

-

The report was based on a survey of more than 1,300 investors across income brackets and age groups in North America also revealed a split between levels of robo trust. Roughly half of investors said they have received good advice from robo-advisors. But about the same number said they would never take the advice of a robo-advisor without first consulting another source.

Dive Insight:

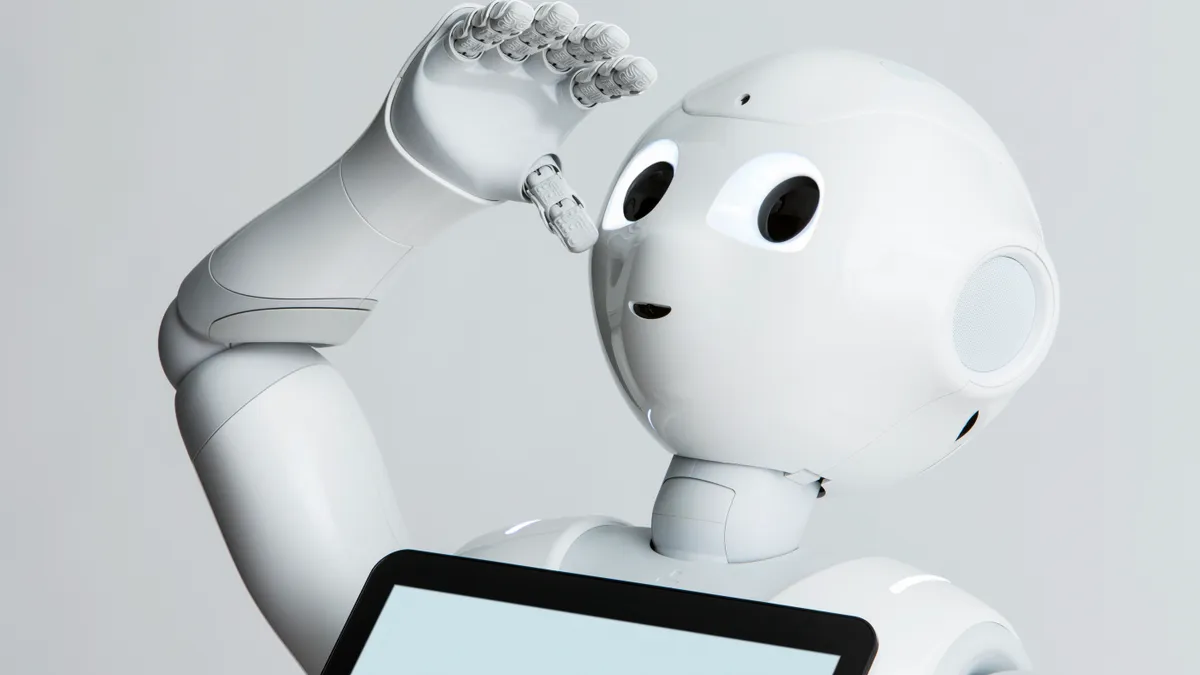

Though the Accenture study focused on investors, it seems a mix of automation and human assistance is often preferred in other areas as well, at least until AI systems improve. While they may be good at certain tasks and handling certain situations, a common complaint about AI or robo systems is that they can’t understand the emotion and tone behind words.

AI systems often don’t remember the way humans do, either, according to Apple’s director of AI research, Ruslan Salakhutdinov, who spoke at an MIT Technology Review conference this week. However, given all the investment going into AI from tech giants like Intel, IBM, Google and Apple, it likely won’t be long until AI systems tackle their current weaknesses.

Companies are turning to automation for relief from many mundane tasks. As technology advances, they too may start relying on AI systems.