Dive Insight:

- Enterprise technology investment plans hit a trade-policy roadblock during the second quarter, marking the “extraordinary impact of U.S. policy volatility on organizational sentiment," according to a recent S&P Global Market Intelligence report.

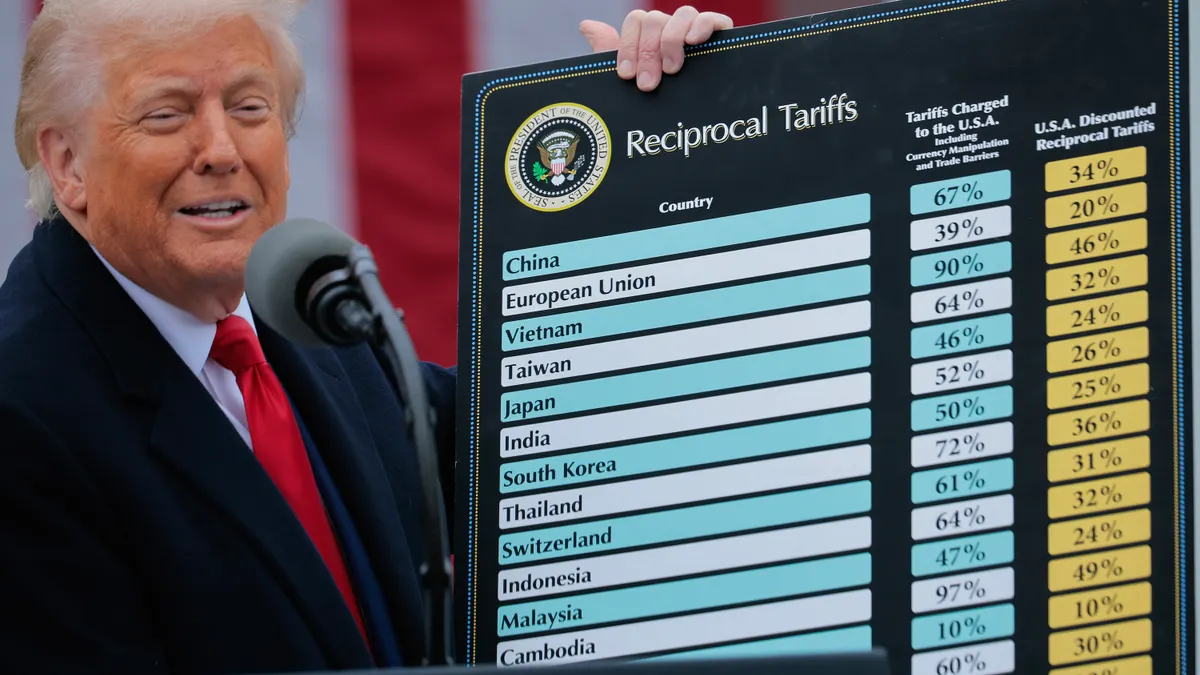

- Businesses reined in discretionary IT spending and took a wait-and-see approach to some initiatives in the wake of President Donald Trump’s April tariff threats, Malav Parekh, S&P Global Market Intelligence research analyst, told CIO Dive. The firm drew on three surveys to assess the IT spending intentions of decision-makers at 1,000 companies.

- Nearly 3 in 5 businesses said external economic conditions had an outsized influence on tech spending decisions, marking the largest single quarter sentiment shift in two years, S&P said in the report. The firm expects the trend to continue through the third quarter.

Dive Insight:

IT budgets were on an upward swing at the start of the year and enterprise technology spend is continuing to increase, despite tariff-triggered turbulence and creeping inflation rates.

Global IT spending is expected to grow 8% year over year to $5.43 trillion in 2025, driven in part by massive cloud data center capacity buildouts and hyperscaler investments in AI infrastructure, according to a Gartner report published earlier this month. However, before trade policy shifted, the analyst firm forecast a slightly larger 10% bump to $5.61 this year.

Uncertainty around U.S. policy and the potential economic fallout of an escalating trade war have taken a toll on enterprise executives, who started the year bullishly and have since downgraded expectations. Fewer than one-quarter of 252 executives surveyed by Gartner anticipate ending the year ahead of where they had planned.

Enterprises are protecting investments in technologies deemed critical to the business, including cybersecurity, AI and cloud, according to S&P Global’s analysis.

Cloud infrastructure was the top spending category during the first quarter of 2025, and sentiment in favor of cloud wavered only moderately in Q2, Parekh said. Sentiment in favor of maintaining cyber and AI investments remained robust, as companies looked to pare back spending on employee device, workforce collaboration and emerging technologies while reducing reliance on IT outsourcing, consulting and managed services.

“Discretionary spending is plummeting,” said Parekh. “Anything that the company thinks of as nonessential — they are going to go at it with a hacksaw.”

There is also a size asymmetry, the firm found. Larger enterprises with expansive IT estates are reacting more sharply than smaller businesses.

“When large businesses catch a cold, smaller businesses get the flu,” Parekh said. “Usually, the moment things go bad in the economy, small businesses completely lock things up. Right now, there is a shift in momentum, but it’s not from the actual impact of tariffs because most of the tariffs are not implemented yet.”