With inflation hitting a 40-year high and a global recession on the cards, there’s no hiding away from the fact that costs are on the rise across the board.

Subsequently, CIOs are being tasked with evaluating, justifying and ultimately reducing IT spend. One specific area of focus is the amount being invested in software-as-a-service (SaaS).

In many modern organizations, SaaS spend now represents as much as 12.7% of total spend, making it one of the largest costs behind salaries. The problem, however, is that it is this area of spending that will be impacted almost immediately by the rise in inflation.

This is because as many as 88% of software vendors have clauses in their contracts allowing them to change their pricing at any given time — in some cases without the need to notify customers. Which means that if they’re not already implementing price increases, then there’s a real risk that they’re considering it.

So, how as an organization can you keep SaaS expenditure down in the face of soaring inflation rates?

According to Robert Naegle, VP Analyst at Gartner, businesses — and more specifically CIOs — have three choices when it comes to preparing for the impact of inflation on their IT budgets:

- Spend the same and do less

- Spend more and do the same

- Try and optimize in order to spend the same and do the same

Fortunately, while organizations may have come to heavily rely on software applications, there are almost certainly opportunities to drive down the cost of SaaS.

To understand where exactly these opportunities lie, we first need to look at the true impact that inflation is having on SaaS vendor pricing.

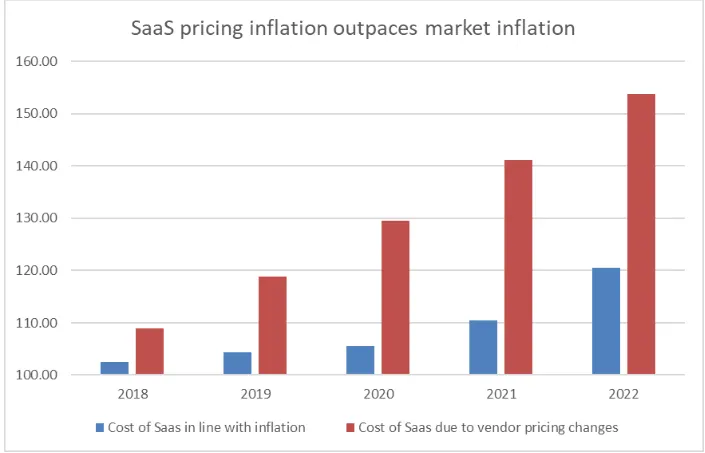

From our analysis of more than 10,000 SaaS contracts, we can see that 74% of vendors have increased their list pricing since 2019. Now while price rises are to be expected, what’s also apparent is that the SaaS inflation rate is around four times greater than the market inflation rate.

More specifically, SaaS spend in the UK and Australia is rising at a rate that is five times higher than market inflation. In Canada and the US it’s slightly less than this, at 4.3 and 3.5 times more, respectively.

The bottom line is that across the globe, SaaS pricing inflation is rapidly outpacing market inflation. Yet, some technology vendors continue to use inflation as a scapegoat for rocketing prices, despite market inflation running at a far lower rate.

But what does this mean for you?

Knowing how SaaS inflation compares to market inflation can give you much needed leverage during vendor negotiations. In fact, by arming yourself with this economic data — and allowing yourself enough to effectively negotiate — you will be in a much stronger position to make informed counteroffers.

But economic data is not the only data you can leverage to drive down your SaaS spending.

One of the biggest challenges for any SaaS buyer is the overwhelming lack of pricing transparency in the market. With as many as 55% of vendors obscuring their pricing, you are often left with no frame of reference, making it incredibly difficult to leverage the best possible cost.

But even for the 45% of vendors that do share their list prices, there’s no easy way of knowing just how willing they are to provide a discount, and just how much other companies are actually paying.

Sure, you may be able to scrape information from some feature comparison sites or find an outdated reference to a vendor’s pricing on a forum, but this data is often fragmented and unreliable.

Which is where Vertice comes in. We provide validated pricing insights and discounting data from thousands of SaaS transactions, giving you the leverage you need to negotiate the best possible deal.

But that’s not all we do.

At Vertice, we also recognize that effective SaaS management requires time, which is why we take the burden of managing, buying and renewing SaaS off your hands.

See for yourself how much we could save you with our free cost savings analysis.