Dive Brief:

- Despite disappointing sales results, Jack in the Box continued its streak of higher-than-normal IT investments, executives said during the fast food chain’s Q4 2025 earnings call Wednesday.

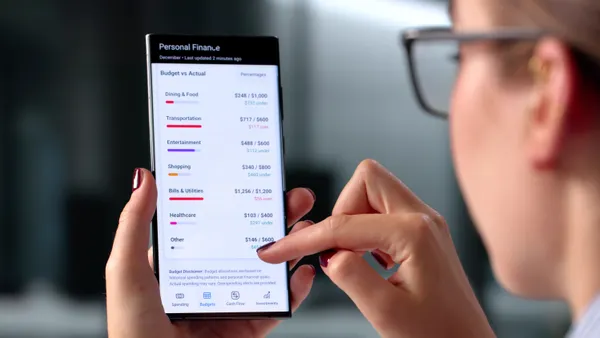

- Capital expenditures were $17.9 million for the quarter, following investments of $22.5 million and $21.5 million in previous periods this year. The spending helped the fast food chain implement a new point-of-sale system, perform platform enhancements, improve data estates and contribute to other modernization projects.

- “We've put a lot of time into tech modernization,” CEO Lance Tucker, who was permanently appointed to the role in March, said during the call. “It is ongoing, and it will build throughout the year and help us a little bit.”

Dive Insight:

Jack in the Box is doubling down on technology investments while experiencing its worst sales results in years during consecutive quarters.

Same-store sales in Q4 declined 7.4% year over year, surpassing a drop of 7.1% during Q3. The weakened performance comes as the fast food chain works to strengthen its balance sheet by closing underperforming restaurants, prioritizing debt paydown and selling Tex-Mex chain Del Taco.

Technology is a key part of the puzzle, supporting the company’s long-term goals. But the efforts have brought short-term challenges. In May, Jack in the Box faced difficulties while trying to integrate modern tools with decades-old legacy systems, resulting in “temporary” sales impacts.

“These issues are unrelated to our new POS systems or the partners involved in the integration,” Tucker said during the fast food chain’s Q2 2025 earnings call. “Rather, they highlight the necessity for Jack in the Box to continue overhauling its technology by investing in the rapid modernization of these legacy systems, which is already in progress.”

By August, the fast food chain had begun to find its tech modernization rhythm, with a new POS system going live in 2,000-plus restaurants.

“I want to thank [SVP, CTO] Doug Cook and the IT organization, our ops team, our vendor partners and our franchisees for installing these ahead of schedule,” Tucker said during the Q3 2025 earnings call. “While we continue to see implementation impacts from temporary downtime, we anticipate these impacts will be short term in nature. The vast majority of issues we discussed last quarter related to our technology modernization have been mitigated.”

Despite the tech inroads, the company is still facing adversity.

“When the sales are difficult and the bottom line results are difficult, the conversations are going to get more pointed,” Tucker said Wednesday.

Jack in the Box is prioritizing “sales-driving” technology investments in the fiscal year ahead as it forecasts capital expenditures in the range of $45 million to $55 million.