Dive Brief:

- Creatio launched six pre-built AI agents aimed at the banking sector, the software provider announced Thursday. The agents are geared toward revenue generation and operational excellence, and can be deployed either as part of Creatio’s platform or independently.

- Referral Agent, Renewal Agent and Retention Agent are focused on adding additional revenue, while Customer Onboarding Agent, Loan Preparation Agent and Loan Servicing Agent are geared toward improving bank workflows, Andie Dovgan, chief growth officer at Creatio, told CIO Dive.

- “We see tremendous success with deploying independent agents that can go and act as a digital employee that helps you to solve a problem and that can sit on top of your existing stack,” Dovgan said.

Dive Insight:

Banks are experimenting with AI agents that act as digital employees to automate routine tasks, improve operational workflows and generate ROI.

Morgan Stanley’s wealth management business is developing multiple AI agents that are “orchestrated by a super agent,” Jed Finn, head of wealth management at Morgan Stanley, said during the UBS Financial Services Conference 2026 on Tuesday. The first super agent under development is focused on branch operations, Finn said.

Working alongside client service associates, the super agent will be able to retrieve information and take action, including beneficiary changes, account creation and money transfers, Finn said during the conference.

“The goal is to automate a lot of the routinized tasks so our CSAs can spend more time on the higher value added tasks, [such as] interacting with clients,” Finn said.

BNY Mellon employs dozens of AI-powered digital employees, CIO Leigh-Ann Russell said during the Gartner IT Symposium/Xpo in October. The “digital engineers” fix low-complexity code issues independently, submitting completion reports to human managers, Russell said.

As large banks develop digital employees in-house, providers are stepping in with their own offerings, including platforms from which to build agents. Salesforce’s Agentforce for Financial Services includes AI agents designed for banking, insurance and wealth management firms.

While Creatio offers an AI agent platform, its recently released set of agents can be deployed independent of the platform.

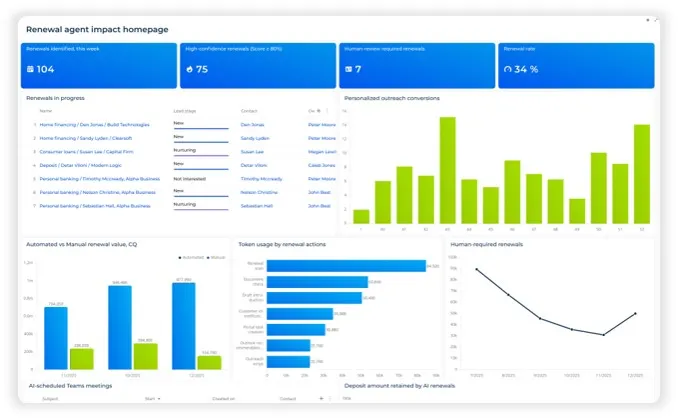

Without changing the technology stack, Dovgan said a bank can get a “very quick uplift in referrals, renewals or retention by deploying those agents” and improve customer experiences. Banks deploying the agents can track performance via a dashboard, such as how many referrals were generated by the Referral Agent and how many referrals resulted in sales.

The agents, designed to “independently execute and orchestrate end-to-end banking workflows,” can operate across productivity tools including Microsoft Teams, Outlook and Zoom, according to Creatio.

Financial services represents roughly 35% of Creatio’s revenue, which helped the company craft the banking-specific agents, Dovgan said. It takes about 10 weeks to deploy one agent, he added.

“We carved out independent agents that are working very specifically for solving particular problems that banks experience,” Dovgan said.

Although the agents are designed to independently coordinate decisions, actions and handoffs across systems, human-in-the-loop controls are maintained, according to Creatio.

The agents are designed to deliver on tangible business outcomes, Burley Kawasaki, SVP of Creatio Industries for Creatio, told CIO Dive.

“Banks are moving beyond pilots and into real implementations,” Kawasaki said. “What we see them starting to really look at is, ‘How do I really tangibly achieve the ROI.’”