Dive Brief:

- Enterprises are battling software spending increases on multiple fronts, triggered by shifts in pricing models, consumption behavior and the vendor environment, according to a Boston Consulting Group report published Thursday.

- “Procurement has become exceedingly complex, and companies are struggling to reduce spending in an increasingly fragmented landscape,” BCG said, pointing to a proliferation of business intelligence, project management and cybersecurity software vendors, consolidation among larger providers and decentralized enterprise procurement decisions.

- IT budgets for third-party services grew by roughly 6% annually from 2019 to 2024, spurred by SaaS spend, which grew from 13% to 21% of total tech budgets in five years, according to BCG’s analysis of Gartner IT spend forecasts. “There are companies that spend over half their total tech budget on software alone,” BCG Managing Director and Senior Partner Ashwin Bhave told CIO Dive.

Dive Insight:

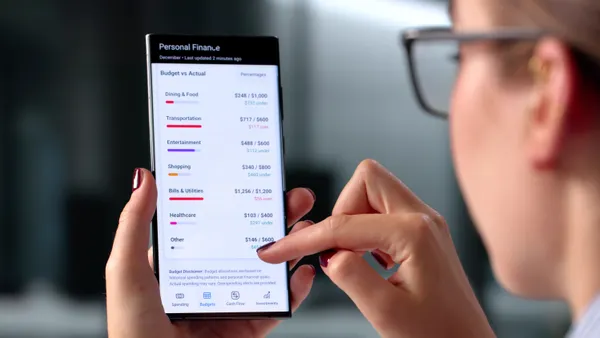

CIOs have seen software eat away at their IT budgets, as vendor offerings proliferate, pay-as-you-go cloud marketplaces expand and emerging technologies capture the imagination of C-suite leaders. The culprits are manifold, tucked away in legacy code, floating around cloud storage tiers and written into the fine print of complex licensing agreements.

“There are entire categories of new software that didn't used to exist,” Bhave said, pointing to Databricks and Snowflake in the data cloud vendor space and observability platform providers Datadog, New Relic and Splunk. “None of these existed a few years ago.”

Providers that address specific industry verticals contribute to the clutter, added Bhave, who noted that a recent search for software to manage landscaping businesses yielded half-a-dozen vendors.

As vendors sunset perpetual licensing in favor of consumption-based pricing models, procurements have become harder to track, leading to redundancies and a proliferation of underutilized “shelfware,” BCG found.

“It’s challenging for procurement because the acquisition of software has become much easier and more seamless, at least in the beginning,” Bhave said. “It becomes more difficult later on.”

Generative AI add-ons to existing software suites have upped the degree of difficulty, as vendors race to deploy coding assistants, knowledge management tools and a new breed of task-based agents designed for individual business functions.

The trend helped drive up software licensing and subscription costs on renewals and new contracts by more than 10% for nearly half of organizations in the last year, according to a West Monroe survey of procurement, IT and finance executives fielded in June.

“Spend on software is accelerating faster than other areas,” West Monroe said in the report, with vendor consolidation, feature complexity and AI integrations driving the spike.

While FinOps practices helped IT and finance iron out cloud overspend, AI-powered software brought a new wrinkle to hyperscaler bills, adding infrastructure costs to the equation, BCG found.

“Boosting the scalability and performance of many software solutions — including new Gen AI offerings — requires increasing the amount of cloud resources available for data storage, compute power, or API calls,” the firm said in the Thursday report.

Companies running generative AI workloads in the cloud report costs that are five to 10 times higher than anticipated, according to IT services firm Flexential.

“These overruns aren’t rare cases — they’re the pattern,” Brian Anderson, Flexential’s senior director of product management, hybrid cloud, told CIO Dive via email. “Companies move workloads expecting efficiency and savings, but the combination of data egress fees, performance add-ons and compliance-related adjustments makes the total spend unpredictable and unsustainable.”

BCG recommends that CIOs use a three-pronged approach to combat rising spend: cultivate strategic partnerships with less aggressive software providers and tier-two players, clamp down on redundant and otherwise unnecessary procurements, and improve the cost performance of existing systems.

Enterprises should take advantage of lower-priced cloud storage tiers, refactor inefficient legacy applications to reduce mainframe compute consumption, and leverage open-source alternatives to higher-priced vendor offerings.

The FinOps Foundation stepped in earlier this year to help stem the tide of SaaS spend with buy-in from some of the major providers. But efforts to standardize software billing are still in the early stages.

“It’s more than just standardizing a set of rules for a few large cloud providers,” Bhave said. “With SaaS, you’re talking about 30, 40 or 50 different vendors, each of which have their own pricing models. Nobody is staffed up to do that.”