Dive Brief:

- Banks accelerated venture investments in AI with a focus on platforms, financial technology, software as a service and cybersecurity, according to Evident Insights’ AI Ventures Tracker report released Thursday. The report tracks 50 global banks, which made a total of 199 tech venture investments in 2025.

- AI-specific investments from banks outpaced the broader market with a 21% compound annual growth rate, while general tech venture deals grew at 8% annually from 2023 to 2025, the report found. The investments align with efforts to incorporate AI into essential operations, build the foundational infrastructure to scale the technology and defend the organization against AI threats.

- Wells Fargo, Citigroup and Goldman Sachs topped the leaderboard for AI deal volume, with six out of the 10 most active banks in AI venture capital based in the U.S.

Dive Insight:

Financial services firms in the U.S. are accelerating AI investments in 2026 as the industry seeks operational efficiency gains largely driven by agentic technology.

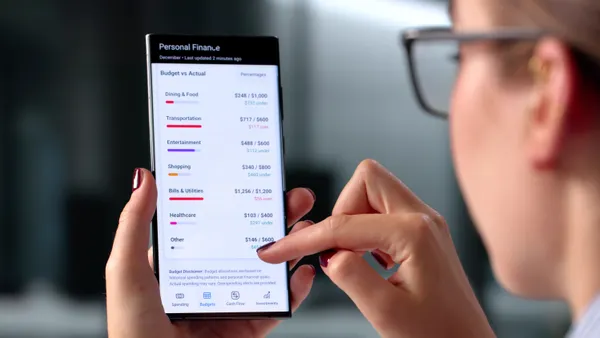

In 2025, Citi Ventures, Goldman Sachs Growth Equity and BNY backed enterprise platform provider Conquest Planning, marking one of the top AI deals of the year, according to Evident Insights. The fintech startup uses AI to assess customers’ financial information and then provides plan options and advice.

Conquest Planning aims to use agentic AI long-term to take actions based on the generated advice, which is where the payoff will come for investor banks, Evident found.

“Cracking that would take the investment from an operational boon into venture-style returns,” according to an Evident Insights brief.

AI adoption is expected to increase across the industry as 42% of U.S. financial firms plan to up internal AI investments by 50% or more, according to a report from software company Finastra. The rising spend comes as banks build out AI platforms and assess where technology such as agents fit into workflows.

Citi, which Evident Insights ranked as one of the most active banks in AI venture capital, recently began piloting an AI-assisted collaboration feature called Spaces within the bank’s AI platform, Stylus Workspaces. The feature was added after the bank launched agentic AI tools on the platform in September.

Meanwhile, Goldman Sachs — another leader in AI deal volume — has identified six operating processes it hopes to reshape with AI to drive efficiency and productivity, according to CEO David Solomon.

“If we can remake processes and create more operating efficiency and flexibility, that will free up more capacity from an efficiency perspective to invest in growth areas,” Solomon said during the bank’s Q4 2025 earnings call in January.

As banks make significant AI investments, the industry will also look to platforms from big tech companies to build agents that align with their brands, compliance and service standards, according to Accenture’s Top Banking Trends for 2026. Anthropic and Infosys, for example, recently announced plans to build agents tailored for the financial services sector.

Agentic AI is expected to move beyond early deployments to broader adoption and scale this year, according to Accenture.

“Leading banks are deploying AI agents across operations, where they work alongside employees and independently handle defined tasks,” Andrew Young, managing director and global talent and organization lead for financial services at Accenture, wrote in the report. “These shifts are rapidly changing the nature of work and will ultimately unlock new efficiencies and growth.”